FOUNDATIONS STEP 2

Save Your First $10,000

Build a financial buffer that changes everything.

Here's the exact system I've used for 20+ years.

Why $10,000 Changes Everything

$10,000 isn't a magic number—but it's enough to give you breathing room. It covers most emergencies without going into debt. It gives you the confidence to invest without fear. And it proves to yourself that you can save consistently.

This isn't about cutting out coffee or living miserably. It's about knowing where your money goes and making intentional decisions.

Emergency Buffer

Handle car repairs, medical bills, or job loss without panic

Investment Capital

Start building wealth through crypto, stocks, or property

Mental Freedom

Sleep better knowing you're not one disaster away from debt

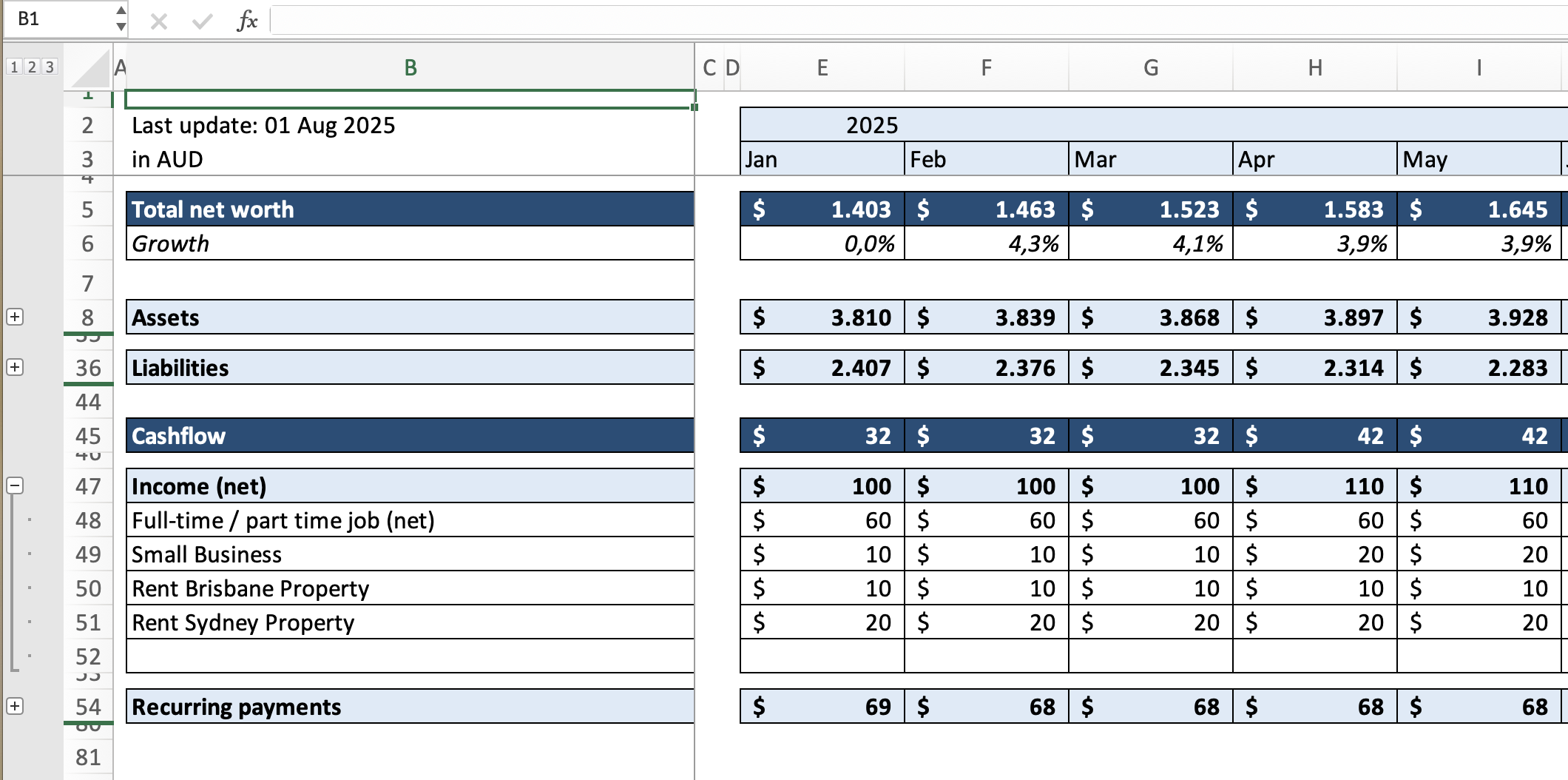

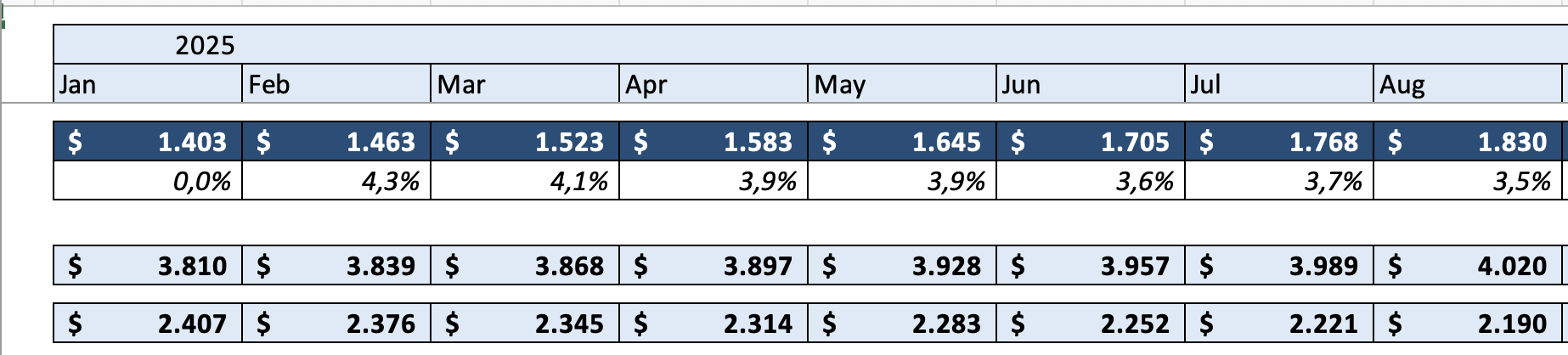

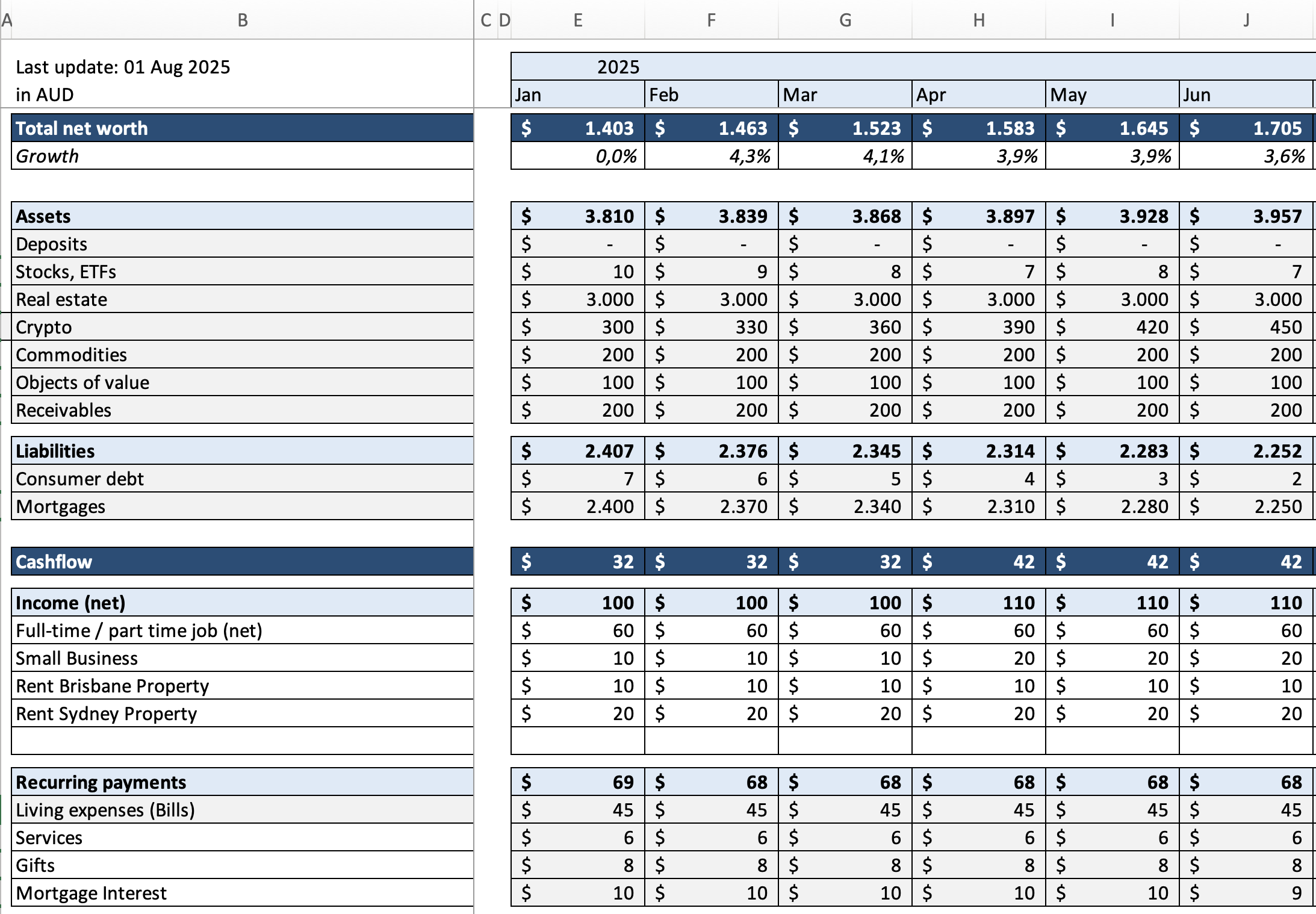

Adrian's Net Worth Tracking Method

I've tracked my net worth monthly for over 20 years using a simple Excel spreadsheet. This isn't complicated—but it's powerful. Here's how it works:

💡 The Key Insight:

Use current market values for assets (not what you paid), and outstanding balances for liabilities. This gives you an honest snapshot. Update monthly to see patterns—even small 2-3% monthly growth compounds dramatically over years.

Understanding Your Cash Flow

Net worth is your score. But cash flow is how you play the game. Here's the simple equation:

💡 The Game Changer:

Most people track expenses. I track net worth and cash flow. This is higher-level thinking. You stop obsessing over $5 coffees and start focusing on the big levers: increasing income, reducing fixed costs, and automating investments.

Get the Cash Flow & Wealth Building Tracker

Download the exact Excel template Adrian has used monthly for 20+ years.

Pre-built formulas for net worth tracking, cash flow analysis, and monthly progress charts.

✓ Free forever

✓ No email required

How to Use the Template

Follow these steps to track your net worth and cash flow.

Takes 30 minutes to set up, then 15 minutes monthly to maintain.

Fill Out Your Current Financial Snapshot

Open the template and enter your current financial position. Start with the easy numbers—monthly rent, salary, account balances.

For tricky estimates (like food budget): Think weekly, not monthly. How much do you spend on groceries per week? Multiply by 52 weeks, then divide by 12 months. Much easier than guessing monthly.

Expand/collapse sections: Click the [+] or [-] buttons on the left sidebar to show or hide detailed categories. This keeps the spreadsheet clean while you work.

💡 International Users:

Australian template uses AUD and DD/MM/YYYY format. Simply change currency symbols and adjust date formats in your spreadsheet settings to match your region (USD, EUR, GBP, etc.).

Assets section expanded showing categories

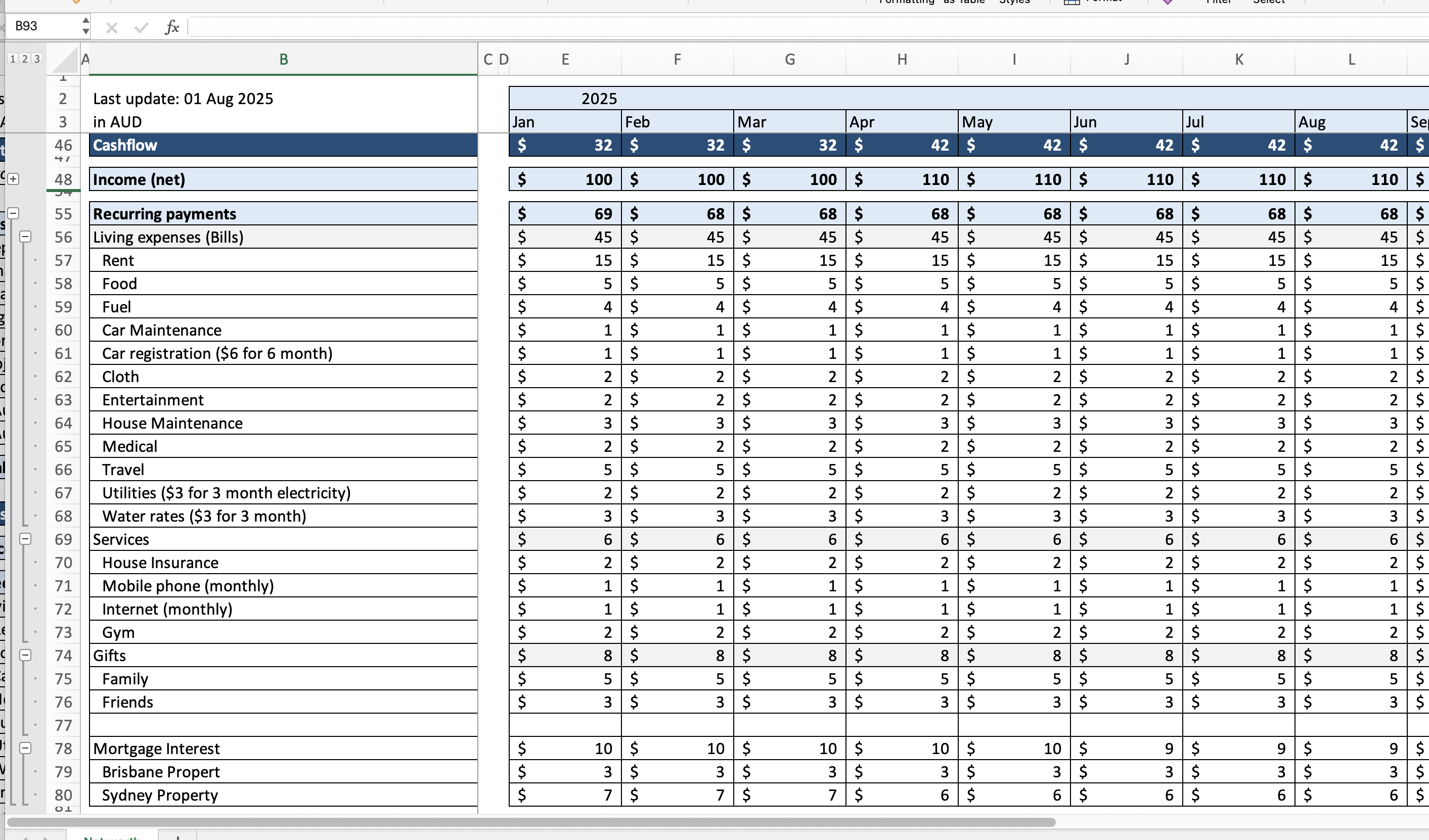

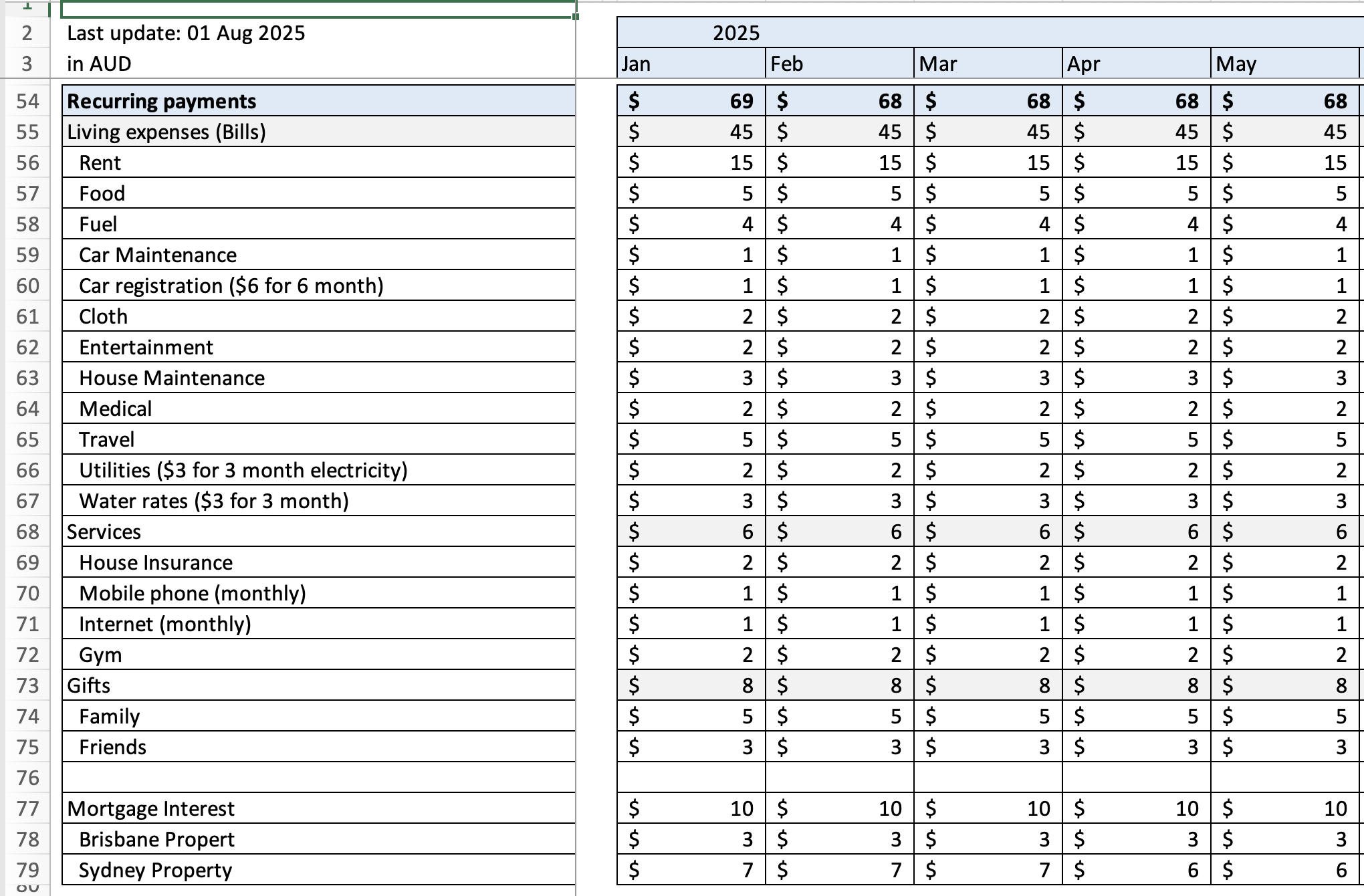

Cash flow and income sources breakdown

Set Up Your Tracking System

Your estimates are just a starting point. Now you need to measure reality against your budget.

The Multiple Bank Account Method (Adrian's system):

- Create separate accounts for major spending categories (groceries, fuel, entertainment)

- Transfer your weekly/monthly budget into each account at the start of the period

- Only spend from that specific account for its category

- Watch your balance—if it's running low, you know immediately

The Cash Envelope Method (alternative):

- Label physical envelopes or jars for each spending category

- Put your budgeted cash amount in each at the start of the month

- When it's gone, it's gone—forces discipline

Track Monthly & Refine Your Budget

At month-end, record all actual income and expenses in the template. Compare against your estimates.

You'll discover:

- Where you underestimated (adjust budget up or cut spending)

- Where you overestimated (reallocate that extra to savings/investing)

- Surprise expenses that need their own budget line

- Your actual spending patterns vs. what you thought they were

Review the Growth % row: The template automatically calculates your month-over-month net worth growth. Aim for consistent positive growth—even 2-3% monthly compounds dramatically over time.

Net worth summary showing monthly growth percentage

Recurring payments breakdown by category

Build Your Emergency Fund (3-Month Buffer)

Your first savings goal: 3 months of total expenses. This is your rainy-day fund for when life happens.

Calculate your target: Add up all your monthly recurring payments and living expenses. Multiply by 3. That's your emergency fund goal.

Where to keep it:

- High-yield savings account (easy access, earns interest)

- Physical gold/silver (inflation hedge, slightly less liquid)

- NOT in stocks or crypto (too volatile for emergency funds)

Once you have this buffer, you'll sleep better. You're not one car repair or job loss away from debt.

💡 Beyond the Basics:

As you grow wealth, aim for multiple income sources—employment, side business, rental income, investments. Never depend on a single income stream.

Make It a Monthly Habit

Set a recurring calendar reminder: First Sunday of every month, 15 minutes.

Your monthly review routine:

- Update all asset values (check bank accounts, crypto wallets, property estimates)

- Update all liability balances (credit cards, mortgages, loans)

- Record actual income and expenses for the previous month

- Review your growth percentage—celebrate wins, investigate drops

- Adjust next month's budget based on what you learned

This 15-minute habit has generated more wealth for me than any investment strategy.You can't improve what you don't measure.

Full dashboard overview with all sections

Video Walkthrough (Optional)

Watch Adrian demonstrate the template setup and his monthly tracking routine.

Video Coming Soon

5-minute guided tutorial showing the complete workflow

Ready to Start Investing?

Once you've built your buffer and have consistent cash flow, it's time to

grow your wealth through smart, cycle-aware investing.